10 Best Wallet Apps in India 2025

With the rapid shift toward digital payments, especially post-COVID-19, mobile wallet apps in India have revolutionized the way we handle transactions. From paying bills to transferring money seamlessly, these wallet apps have become indispensable in our daily lives. But with so many options available, which ones truly stand out? This article dives deep into the 10 Best Wallet Apps in India 2025, exploring their features, unique offerings, and why they are the go-to choice for millions.

The Rise of Digital Wallets in India

In the last decade, India has witnessed a seismic shift in its payment ecosystem. Gone are the days when cash was king—today, it’s all about convenience, speed, and security. Enter digital wallet apps, the ultimate game-changers. These apps, fueled by UPI (Unified Payments Interface), have transformed smartphones into portable wallets, allowing users to make payments, transfer funds, and even shop online—all in just a few clicks.

But what sparked this shift? The pandemic played a pivotal role in accelerating the adoption of contactless payments. With social distancing becoming the norm, digital wallets emerged as the safest way to transact. Moreover, government initiatives like “Digital India” and the introduction of UPI have made these apps not just convenient but also essential.

Why Are Wallet Apps So Popular?

- Convenience: Instant payments at your fingertips.

- Security: Advanced encryption ensures safe transactions.

- Rewards & Cashback: Who doesn’t love earning rewards while spending?

- Wide Acceptance: From local vendors to e-commerce giants, wallet apps are accepted almost everywhere.

In this comprehensive guide, we’ll explore the 10 best wallet apps in India 2025 that have redefined how we manage our money. Whether you’re looking to pay bills, recharge your phone, or transfer money, these apps have got you covered.

Best Wallet Apps in India 2025

|

Wallet App |

Unique Feature | Installs (Android) | Launch Year |

|---|---|---|---|

| Google Pay | Seamless UPI payments, no wallet reloads | 100M+ | 2017 |

| PhonePe | Multi-language support, fast transfers | 100M+ | 2015 |

| Paytm | Versatile usage, wide merchant network | 100M+ | 2010 |

| Amazon Pay | Integrated with Amazon shopping | 50M+ | 2017 |

| Mobikwik | Expense tracker, doorstep cash collection | 10M+ | 2009 |

| Dhani | Cashback on SuperSaver card | 20M+ | 2017 |

| BHIM Axis Pay | Easy UPI transactions | 1M+ | 2017 |

| ICICI Pockets | Virtual VISA card for online shopping | 5M+ | 2015 |

| HDFC PayZapp | One-click payments | 10M+ | 2015 |

| Yono by SBI | Multi-language support | 10M+ | 2017 |

10 Best Wallet Apps in India 2025

1. Google Pay: The UPI Pioneer

Google Pay, formerly known as Tez, has set the benchmark for digital payments in India. Backed by the tech giant Google, this app combines simplicity with powerful features, making it the most popular wallet app in India.

Unique Features:

- Direct bank-to-bank transfers via UPI.

- Scratch cards and cashback rewards for every transaction.

- No need for wallet recharges; directly linked to your bank account.

- Supports bill payments, phone recharges, and online shopping.

Why People Love It:

Google Pay’s clean interface and secure transactions have won over millions. The app also allows users to split bills, making it ideal for group payments. Its integration with Google’s ecosystem ensures seamless functionality across devices.

Read more about 10 Best UPI Apps in India

2. PhonePe: A Versatile Payment Solution

PhonePe, a product of Flipkart, is another giant in the UPI and wallet app space. Known for its multilingual support, PhonePe is user-friendly and feature-rich.

Unique Features:

- UPI payments, recharges, bill payments, and more.

- Support for regional languages, making it accessible across India.

- Integration with major e-commerce platforms.

Pro Tip: Use PhonePe during Flipkart’s sales to avail exclusive discounts and cashback offers!

3. Paytm: The Veteran in Digital Wallets

Paytm is synonymous with digital wallets in India. From small roadside vendors to large retailers, everyone accepts Paytm.

Unique Features:

- Semi-closed wallet model for added flexibility.

- Supports UPI payments, bill payments, and online shopping.

- Dedicated marketplace for various services, including travel and entertainment.

Did You Know? Paytm was one of the first wallet apps in India to integrate QR code payments, making transactions hassle-free.

4. Amazon Pay: The Shopper’s Delight

Amazon Pay is a one-stop solution for frequent Amazon shoppers. Launched by the e-commerce giant, this app simplifies payments and offers exciting rewards.

Unique Features:

- Integration with Amazon shopping.

- Supports no-cost EMI options.

- Rewards for every purchase made using Amazon Pay.

5. Mobikwik: Beyond Just Payments

Mobikwik offers more than just payment solutions. Its expense tracker feature is a standout, helping users manage their budgets effectively.

Unique Features:

- Expense tracker to monitor spending habits.

- Doorstep cash collection for wallet top-ups.

- Tie-ups with grocery stores and restaurants.

6. Dhani: Your Financial Companion

Dhani, by Indiabulls, is not just a wallet app—it’s a comprehensive financial solution.

Unique Features:

- Dhani SuperSaver card with 5% cashback on all purchases.

- Loyalty program with games and rewards.

- Supports EMI payments and insurance renewals.

7. BHIM Axis Pay: Simplicity at Its Best

BHIM Axis Pay leverages the power of UPI to offer seamless transactions.

Unique Features:

- Instant money transfers using just a smartphone.

- Prepaid mobile and DTH recharges directly from the app.

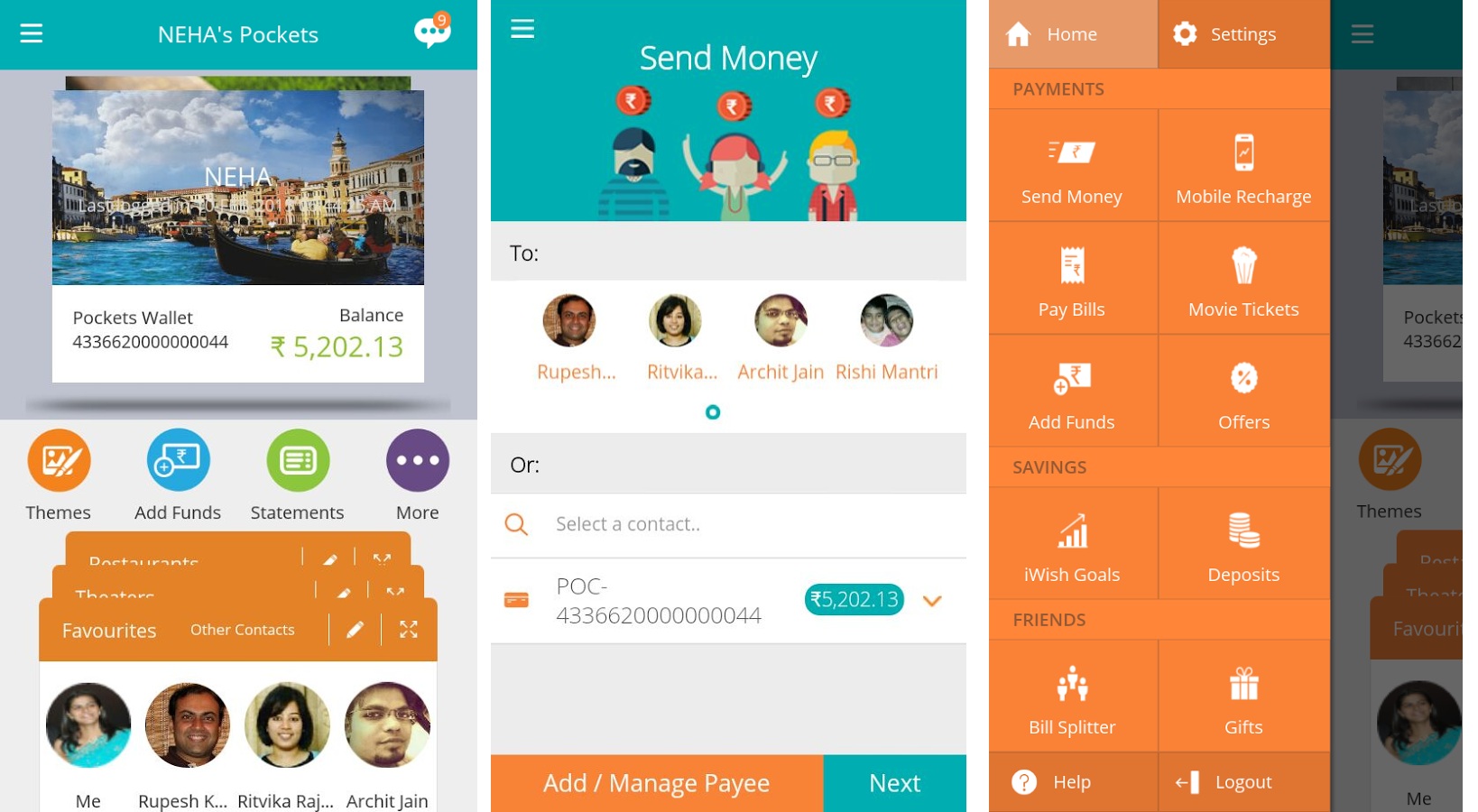

8. ICICI Pockets: A Wallet for Millennials

ICICI’s Pockets app is tailor-made for tech-savvy users who love online shopping.

Unique Features:

- Virtual VISA card for hassle-free online transactions.

- Split bills and send gifts to friends.

9. HDFC PayZapp: One-Click Wonder

PayZapp by HDFC simplifies payments with its “One Click” feature.

Unique Features:

- Book tickets, pay bills, and shop online seamlessly.

- Integrated offers on HDFC’s SmartBuy platform.

10. Yono by SBI: More Than a Wallet

Yono, the official app by SBI, offers a range of services beyond just payments.

Unique Features:

- Multi-language support.

- Bill reminders and mini-statements.

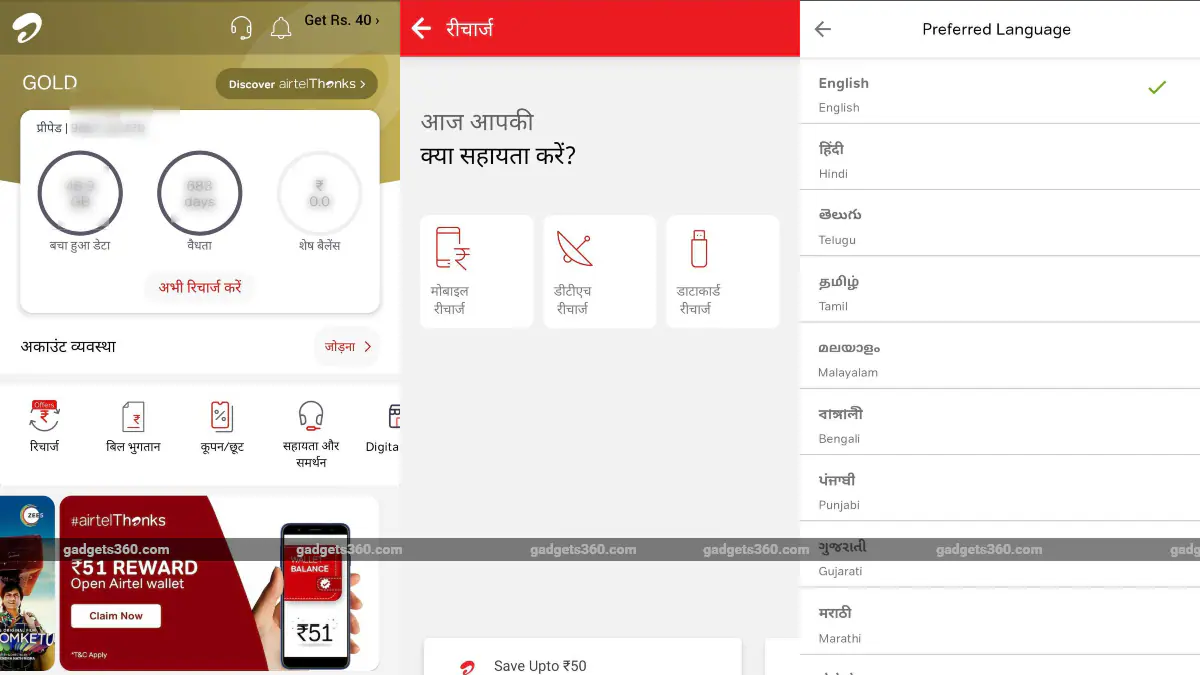

11. Airtel Thanks App

The Airtel Thanks App is a versatile platform provided by Bharti Airtel. Initially designed for Airtel customers to manage their telecom services, it has evolved into a comprehensive payment and financial services app. Through this app, users can recharge their phones, pay utility bills, and manage bank accounts. It also supports UPI transactions, offering seamless money transfers and merchant payments.

One standout feature is its integration with Airtel Payments Bank, allowing users to create digital savings accounts and earn interest. Airtel Thanks also provides exclusive rewards like cashback, offers, and discounts on partner platforms.

Unique Features:

- UPI-enabled for fast and secure payments.

- Airtel Payments Bank integration for digital banking.

- Offers exclusive benefits like cashback and vouchers.

- Airtel Xstream integration for entertainment.

- End-to-end encryption for secure transactions.

Number of Installs: Over 100,000,000+ (100 Million or 10 Crores) on Android Play Store.

With its growing user base and integration of multiple features, the Airtel Thanks App has secured its spot among the top wallet apps in India

FAQs

1. Which wallet app is the best for UPI payments?

Google Pay and PhonePe lead the UPI space with their seamless integration.

2. Are digital wallets secure?

Yes, most wallet apps use encryption and multi-factor authentication for secure transactions.

3. Can I use wallet apps without KYC?

Some apps allow limited functionality without KYC, but full access requires verification.

Conclusion

The 10 Best Wallet Apps in India 2025 cater to a variety of needs, from shopping to bill payments and everything in between. Whether you’re a tech enthusiast or a casual user, there’s an app tailored just for you. Embrace the digital revolution and transform the way you handle your money today!

![10 Best Pregnancy Apps in India [year]: Empower Your Journey to Motherhood! 10 Best Pregnancy Apps in India](https://eleven-best.com/wp-content/uploads/2024/12/Pregnancy-App.avif)

![10 Best Task Management Apps for Teams [year] : Boost Collaboration and Productivity 10 Best Task Management Apps for Teams](https://eleven-best.com/wp-content/uploads/2025/04/best-free-project-management.jpg)

![10 Best Instant Loan Apps in India [year] to Meet Your Financial Needs 10 Best Instant Loan Apps in India](https://eleven-best.com/wp-content/uploads/2024/12/Best-instant-loans-apps-in-India-1.png)